Indicators on Clark Wealth Partners You Need To Know

Table of Contents7 Simple Techniques For Clark Wealth PartnersThe Best Guide To Clark Wealth PartnersClark Wealth Partners for BeginnersThe 6-Minute Rule for Clark Wealth Partners10 Easy Facts About Clark Wealth Partners ShownAn Unbiased View of Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersSee This Report about Clark Wealth Partners

Typical factors to think about an economic consultant are: If your monetary scenario has come to be more intricate, or you do not have self-confidence in your money-managing abilities. Saving or navigating major life occasions like marital relationship, separation, kids, inheritance, or job modification that might significantly influence your financial situation. Browsing the shift from saving for retired life to protecting wide range during retirement and just how to develop a strong retired life earnings strategy.New technology has brought about more extensive automated monetary tools, like robo-advisors. It's up to you to explore and determine the ideal fit - https://anotepad.com/notes/4mg4qd77. Ultimately, an excellent economic advisor ought to be as mindful of your investments as they are with their own, avoiding excessive charges, conserving cash on tax obligations, and being as transparent as feasible about your gains and losses

Not known Details About Clark Wealth Partners

Making a compensation on item suggestions does not necessarily indicate your fee-based consultant functions versus your ideal rate of interests. They might be a lot more likely to recommend products and services on which they gain a payment, which may or might not be in your best passion. A fiduciary is legally bound to place their customer's rate of interests first.

This basic enables them to make referrals for investments and solutions as long as they suit their client's goals, risk resistance, and monetary situation. On the various other hand, fiduciary advisors are legitimately obliged to act in their client's finest interest instead than their very own.

Some Known Factual Statements About Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving into complicated economic topics, dropping light on lesser-known investment opportunities, and revealing ways visitors can function the system to their benefit. As a personal financing specialist in her 20s, Tessa is really knowledgeable about the influences time and uncertainty carry your investment decisions.

It was a targeted promotion, and it functioned. Read extra Read much less.

The Only Guide for Clark Wealth Partners

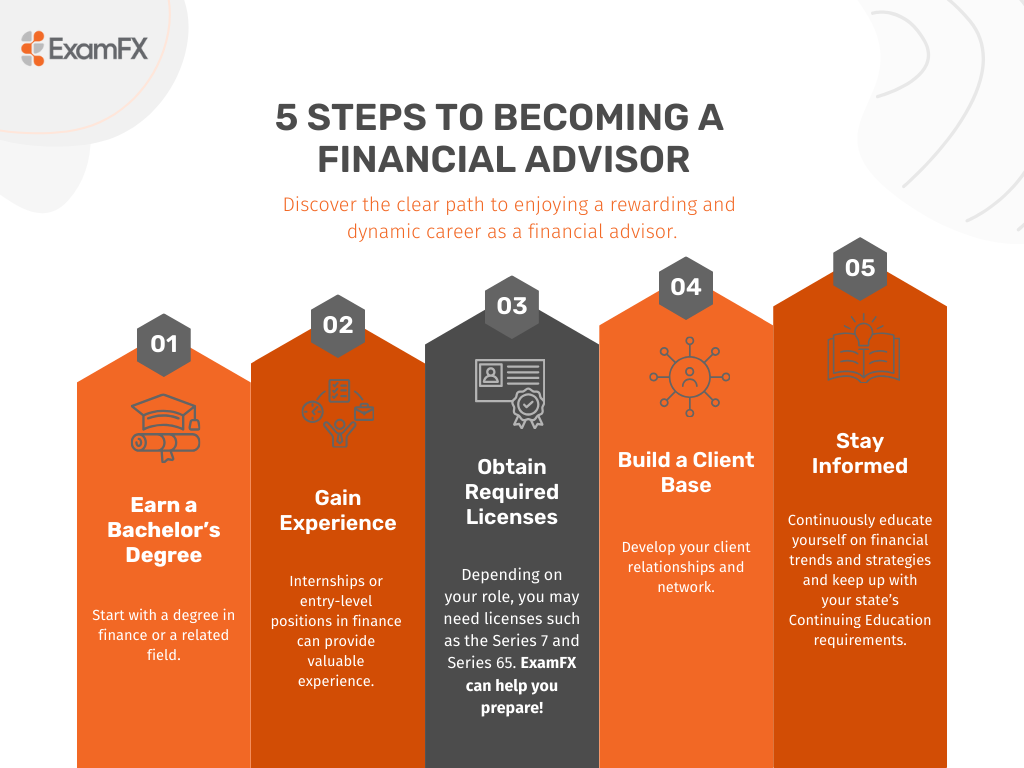

There's no single path to coming to be one, with some people beginning in financial or insurance, while others start in audit. A four-year degree provides a strong structure for professions in investments, budgeting, and client services.

The Buzz on Clark Wealth Partners

Common instances consist of the FINRA Collection 7 and Collection 65 examinations for safety and securities, or a state-issued insurance coverage certificate for selling life or medical insurance. While qualifications may not be lawfully needed for all intending roles, employers and clients often see them as a criteria of professionalism. We take a look at optional qualifications in the next area.

Many economic organizers have 1-3 years of experience and knowledge with financial items, compliance criteria, and direct customer interaction. A strong academic history is important, yet experience demonstrates the ability to apply theory in real-world settings. Some programs integrate both, enabling you to finish coursework while gaining monitored hours through internships and practicums.

The Clark Wealth Partners Ideas

Early years can bring lengthy hours, pressure to construct a customer base, and the demand to consistently verify your knowledge. Financial organizers appreciate the chance to work carefully with clients, overview essential life choices, and typically achieve versatility in schedules or self-employment.

They spent less time on the client-facing side of the industry. Virtually all economic supervisors hold a bachelor's level, and lots of have an MBA or comparable graduate level.

The 30-Second Trick For Clark Wealth Partners

Optional certifications, such as the CFP, generally call for additional coursework and screening, which can prolong the timeline by a couple of years. According to the Bureau of Labor Stats, individual monetary consultants gain an average yearly annual wage of $102,140, with leading income earners gaining over $239,000.

In various other provinces, there are policies that need them to satisfy certain requirements to utilize the monetary consultant or monetary coordinator titles. For economic organizers, there are 3 typical classifications: Qualified, Personal and Registered Financial Planner.

The 4-Minute Rule for Clark Wealth Partners

Those on wage may have an incentive to advertise the services and products their employers provide. Where to find a monetary expert will depend upon the kind of recommendations you require. These establishments have personnel who might aid you comprehend and get specific kinds of investments. Term down payments, assured investment certificates (GICs) and common funds.